Paragraph

1: Describe the grade and subject area

for the lesson. What will students be expected to do in the lesson? The subject area is Social Studies,

Economics and Financial Literacy. This

lesson is targeted to 10th grade students. Students will learn the fundamentals that

guide individuals about choices and how to use limited resources to satisfy

their wants. The fundamentals start with

understanding what financial planning is and how to implement the basics into a

personal plan. Manage financial

resources in order to establish a foundation for financial security.

Paragraph

2: What are the Common Core

standards/required standards this lesson is designed to meet? Discuss how the

different activities in the lesson address the standards.

This

lesson was found in the orc.org website; however, the lesson is from the North

Carolina Education Consortium. This

lesson was found in the Ohio Resource Center (www.orc.og) Consortium page

because North Carolina and Ohio share common core standards (Race To The

Top). The required standards for this

lesson include:

NC

Essential Standards for Civics & Economics (to be implemented in the

2012-2013 school year):

· CE.PFL.1.2- Explain

how fiscally responsible individuals create and manage a personal budget that

is inclusive of income, taxes, gross and net pay, giving, fixed and variable

expenses and retirement

· CE.PFL.1.5- Analyze

how fiscally responsible individuals save and invest to meet financial goals

(Source: http://civics.sites.unc.edu/files/2012/05/PersonalFinancialLiteracyINTRO10.pdf)

Students

will incorporate various activities from the lesson. For instance, establish financial plan:

financial goals, long term & short term; discover the stages of decision

making; and students will maintain a spending log for two weeks. These activities will help students

prioritize their income and discern how to distribute their income. The spending log will help students

understand how they currently use their money.

Once they understand their spending pattern, they will understand how to

prioritize their spending and set goals.

Ultimately, students will gain the knowledge that lead to long term financial

success.

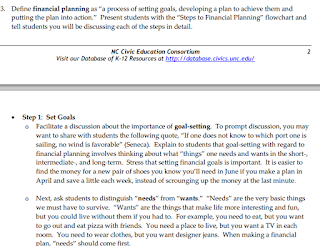

Paragraph

3: discuss how you would implement this

lesson in your classroom. What parts would you anticipate would pose a problem?

What parts would challenge your students?

The

lesson plan is very direct. I believe in

hands-on, experiential activities and the first activity is a “True or False”

game. Students are involved throughout

the lesson, and are engaged throughout.

The only challenge I anticipate is that students may forget to record

their spending; therefore, I will challenge them to create a plan using their

technology device rather than relying on the paper.

No comments:

Post a Comment